Victoria's Secret Market Research? Or not.

Yes, in the past I have bought from VS, and do still buy their bras from time to time, despite the price tag. So I got sent an online survey. I always take these market research surveys for professional reasons, since I write them myself for clients from time to time. This one was, well, just strange.

It's hard to judge it as bad or good without knowing what branching logic they have built in. Branching means: If a respondent picks option (a), show them a different followup set of questions than if they had picked option (b). So I may not have seen the whole thing, and may have ended up in a strange cul-de-sac for people who buy bras because they're sexy. I hope not.

When I got to this checklist of "how does your bra makes you feel" (or somesuch), I was genuinely surprised. There are no negatives in here, and the word "supported" doesn't appear. I wonder what they can learn from this, apart from what they want to hear? The only way to avoid their positive bias is to check nothing, which I suspect will be tough for that helpfully-minded customer set that like to fill out surveys.

Previous to this question, they asked about other retailers you buy from. Now, if they had the usual sort of market research plan, I would expect to see an attempt at a basic SWOT analysis on the results: analysis of their strengths, weaknesses, opportunities, and threats.

How do you do that? Well, the logic is roughly this:

- Ask:Where do you buy your bras?

- Ask:What's important to you about your bra?

- Ask:What's your feeling about the bra you bought?

- Data analysis: For people who bought from us in (1), what's the difference between (2) and (3). If there's a big gap, that's our opportunity, going forward. (And roughly, strengths and weaknesses, when you compare against people who bought from Sears and Macy's and Frederick's of Hollywood on the same dimensions.)

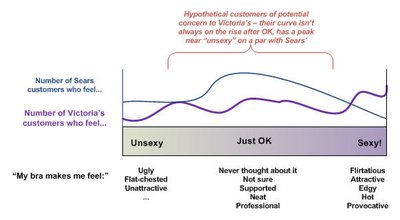

With the right vocabulary choices, including negatives and neutrals, they could have done some interesting segmentation based on where their own customers fall in "feeling" versus the other retailers' customers. Something like this:

They can always conclude from their data that some of their customers aren't that interesting to them from a marketing perspective (e.g., the people who shop at Sears, like their stuff a lot, and only occasionally go into a VS store -- because they'll be hard to capture if they're not dissatisfied enough with Sears).

In any case, some other common mistakes I see in market research via survey:

- You try to collect too much in one survey, and can't do the analysis (plus you irritate the people who filled it out). You can always get more data later in other forms.

- You don't know what you're trying to get out of it, so you can't construct the instrument well to get anything at all.

- You set it up to learn what you want to hear (which is what I think was going on with VS -- I won't even tell you about the underwear questions), so you learn nothing and waste time, money, and your customers' patience.

- You collect the data, then don't know what to do with it. You either don't do much, because of lack of skills in data analysis (clustering, mining, etc), or worse, you do nothing. You have it, but didn't take advantage of it. (This makes me quite uptight when I run into it. Good data is gold. My consulting tagline is "data-driven" for a reason.)

- You solicit data from the wrong people, but don't even know it, because your survey didn't check on their credentials for answering and providing input. So you can't toss out any of the responses to clean the rest of the data.

4 Comments:

My experience with fashion (it doesn't exactly show - but i have a bit). Is the fashion houses and theme marketers see themselves as dictating style and image. The concept of actually using a survey is beyond them (trust me on this one:-)

They see themselves as offering the consumer a fantasy rather than reality, so how can a bra be thought of as uncomfortable?

(You can't image the bizarre discussion I had with the head of a fashion house on why models need to be six feet tall and size zero -- there is a firm belief that women are incapable of "momentary fantasy" (the industry term) that stimulates buying.)

Out of touch doesn't begin to describe these people.

One of the things I like about you is your weird history with the fashion industry :-) Or is that, your history with the weird fashion industry.

I was amazed VS was even doing a survey, but then, it's the hot thing now. I get inundated by requests to give feedback on sites and fill in surveys everywhere I turn. Customers are being asked for their input, but then it's being done badly, being analysed badly, or worse, being ignored once it's collected. There is a huge gap between collecting data and making decisions and changing course based on data. It's one of the "crimes" towards customers that bothers me most in the business world.

Perhaps this is just one of those surveys that were proposed by the marketing department?

"100% of the correspondants surveyed said that they liked how their VS bra made them feel!" :)

Well there never was a doubt on the quality of stuff made by VS. It is known for its style, elegance and comfort........

Post a Comment

<< Home